Wholesale, Contractor & Non-Profit

ATTENTION Sales Tax Exempt Wholesale Purchasers and Non-Profit Entities

Please submit current sales tax-exempt forms before your purchase!

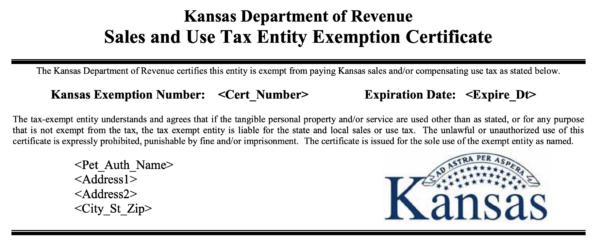

Non-profit entities must provide the government-issued Sales and Use Tax Entity Exemption Certificate.

All sales tax-exempt purchases must be paid for from a tax-exempt entity account. We cannot accept cash or payment by private entities on behalf of the tax-exempt entity.

All purchases made without current and complete tax forms will be charged sales tax.

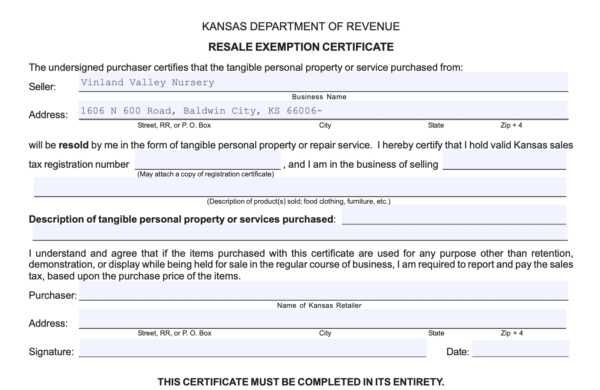

Wholesale resellers please use the fillable KDOR Retail Exemption Certificate, downloadable here.

Contractor/Retailers are required to provide the KDOR Contractor/Retailer Certificate.

All sales tax-exempt purchases must be paid for from the tax-exempt entity account. We cannot accept cash or payment by private entities on behalf of the tax-exempt entity.

All purchases made without current and complete tax forms will be charged sales tax.

According to KDOR: “The purchaser is responsible for ensuring it is eligible for the exemption in the state it is claiming the tax exemption from. The purchaser is liable for any tax and interest, and possible civil and criminal penalties imposed by the state, if the purchaser is not eligible to claim this exemption.”